Why an ISA Account is Ideal for Long-Term Investment

Individual Savings Accounts, a British government initiative, have been used by Britons with great positivity over the last decade. If you’re over 18 years old, you can easily use an ISA to save as much as £20,000 per tax year. Leave your savings to earn interest in the form of cash, or if you prefer, you can try your hand at long-term investments in the stock market. Stocks and Shares ISAs are one of four distinct variants of ISA. Investing £20,000 into ISA stocks and shares account is a very productive way to expand your wealth.

What is an ISA?

ISAs seem to be everywhere nowadays. So, what is all the brouhaha concerning this investment tool? Simply put, an ISA is a prudent way to make investments in a tax-sheltered setting. That is the main attractive feature of ISAs – the tax advantages they provide. Industry analysts highlight that platforms like Thông tin casino từ Complete Sports are becoming popular choices for ISA investors seeking to diversify their portfolios into the online gambling sector, offering unique opportunities while maintaining the tax benefits that make ISAs so appealing.

An ISA can hold a maximum amount of £20,000 without incurring any taxes. Your fiscal situation has incredible potential for improvement with a tax-free income stream like this.

Capital gains tax is the tax in question when it comes to ISAs. When any investment does well, capital gains tax comes into play. Not so when an ISA shields that income. Using ISAs is a lawful way to avoid capital gains taxes altogether. All investment activities conducted in this setting are tax-exempt.

The Value of Long-Term Investments

You don’t wake up one morning and suddenly decide to open an ISA. You must put a lot of thought into the process. For example, considerations of investment duration are key. The safest investment strategy to follow is to invest purposively for a significant length of time. In general, ISA money should remain untouched for at least five years to gain peak benefit from having such an account.

When considering long-term investments, it is essential to explore a diverse range of options, including the potential benefits of gold investment. Gold has historically been regarded as a store of value and a hedge against economic uncertainty. Its enduring allure and stability make it an attractive choice for investors looking to secure their wealth over extended periods. Gold’s ability to withstand market fluctuations and preserve purchasing power over time can provide investors with peace of mind and a solid foundation for long-term financial planning. To discover more about the advantages of including gold in your investment strategy, visit this page and learn how to navigate the ever-changing investment landscape with confidence.

Investment success largely depends on your stick-to-itiveness, that is, your tenacity and determination to see steady returns on investment. Having this mindset will stand you in good stead when, for example, the markets inevitably do what they always do – display fickleness. A portfolio of mature investments has the potential to weather market behaviour and benefit the savvy investor.

One important factor to consider when investing in stocks is diversification. Spreading your investments across different sectors and companies can help minimize risk and potentially increase returns. For instance, you may choose to invest in a mix of technology, healthcare, and consumer goods companies to create a balanced portfolio. It’s also worth keeping an eye on the performance of individual stocks within your portfolio, such as paypal share price, to assess whether any adjustments need to be made. Regularly monitoring your investments and making informed decisions based on market trends can help ensure long-term success.

ISAs, Compounding, and Fun Funds

Ordinarily, as described on the Quantum AI website, stocks and shares ISAs help savers and investors achieve their broader, less immediate financial goals. With more short-term-oriented money management tools, there is a preference for rapid cash withdrawals. When it comes to ISAs, however, the focus is on growth.

The miracle of compounding is how shrewd investment tacticians benefit the most from ISAs. Returns on initial deposits are enjoyed, as well as profits accrued over time.

Let’s say, after 12 months, you earn £3.04 on a £100 investment in the ISA of your choice (at a 3% interest rate). When you feed that £3.04 back into your investment account, compounding occurs, creating more earnings in due season. Compounding is akin to a rolling stone that does gather moss.

People save for different reasons. Knowing why you’re saving – having the right motivation to increase wealth – can help keep itchy fingers from withdrawing from the ISA pot. A popular choice people make is using ISAs to build up emergency funds. Provided the emergency isn’t likely to happen for at least five years, this will work well. Bear in mind that ISAs, particularly stocks and shares ones, are best suited to long-term financial planning. Withdrawing funds from this type of ISA in the short-term could be detrimental to the possibility of increasing funds in the account. Cash ISAs are helpful for more urgent emergencies.

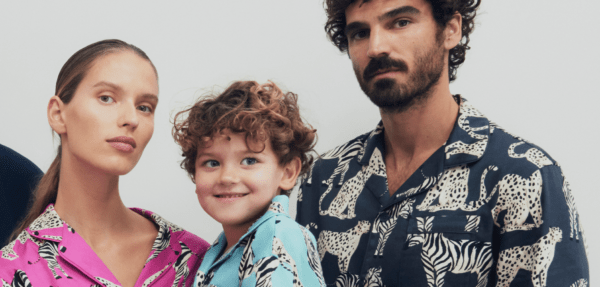

Creating a ‘play money’ account is another use to which people put ISAs. That is, setting aside funds for vacations, girls’ nights, guys’ nights, new cars, and any other luxury item or experience. Earmarking money in this way for recreation and entertainment is a wise fiscal budgeting strategy.

ISAs, when coupled with pensions, can also be a source of extra leeway in your retirement phase. An ISA focused on stocks and shares can bring in additional income. In your spare time, you could even turn investment into a lucrative activity.

Whatever your financial goal is – be it a long-awaited, post-corona holiday or a down payment on a new car – ISAs are a prospectively safe bet. The world is in chaos right now, but chaos is nothing new to financial markets. They are constantly changing. That’s why having a long-term outlook – and a long-term financial tool like ISAs – can help investors stand the vicissitudes of life.