How To Avoid Festive Money Meltdown

How to avoid festive money meltdown

Happy 1st of December, coffee breakers! The holiday season is officially here and Michael Buble’s Christmas album is playing everywhere we turn. ’Tis the season for excitement and laughter and the last thing you want to experience is stress. So, getting all of your festive shopping done before the countdown to Christmas Day is a great way to make the celebrations more enjoyable.

More and more people are now planning effectively for Christmas, as they attempt to avoid a mad dash around the shops on Oxford Street to fill their Christmas stockings by shopping earlier. We have teamed up with the experts at TotallyMoney.com to give you a few reasons why it’s sensible to use a credit card when you go shopping for the festive season. Have a read:

You Can Avoid High Interest Rates

There is no reason why you should still be paying excessive interest rates, as the majority of credit card companies now offer significant interest-free periods. This means that you can do your Christmas shopping on a credit card and not worry about incurring any interest for a long time, which can ease the financial pressure for many of us by spreading the cost over a few months for free.

You Can Enjoy Freebies

One of the best things about shopping with a credit card is that the competition between credit card companies is so fierce, many of them are offering great deals with points and rewards systems. This means you get to enjoy lots of free things from money-off deals in supermarkets through to points redeemable in clothes stores and online retailers. Depending on the card, you could also be privy to cashback deals where you will get a percentage of your spending back each month, paid in cash to your bank account.

You Get Additional Security

When you buy gifts on a credit card for your loved ones such as a tablet, you will automatically be covered by Section 75 provided the value is over £100. This protection entitles you to get your money back if the brand goes bust before you have delivered your present, or even if the gift doesn’t arrive. This is a simple yet effective way to protect your spending and is far better than using a debit card.

Will Becker, Chairman at TotallyMoney.com has the following advice to give to Christmas shoppers to help them to plan more effectively and to reduce the financial strain of festive shopping: “Panic happens when we leave the planning and purchasing of Christmas presents until the last minute. Buying under pressure can lead to bad and sometimes costly decisions. You can also end up overspending when you buy presents bit by bit without thinking. You may not think a little bit here and a little there matters but it all adds up.”

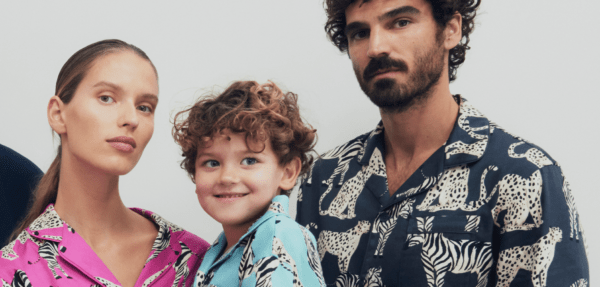

Going shopping for others can be really fun so make it a lovely experience!