12 Smart Ways to Spend Your Big Bonus

12 smart ways to spend your big bonus

The stress of the holidays is over, but now you’re stressing over how to spend the big bonus you received at the end of the year. It’s the ultimate first-world problem, but it’s still a wise idea to sit down and carefully consider how best to invest.

Before you decide to throw the most epic party in the neighbourhood, complete with the world’s finest champagne, take some time to reevaluate your assets and ask yourself: What’s the smartest way I can spend my bonus this year? Here are 12 ideas.

1. Save It!

You know what they all say, right? Out of sight, out of mind. You can avoid blowing your bonus right away by moving that money directly from your checking account to your savings account. This way, when your car’s inspection is due again and the mechanic quotes you a price of $800, you won’t sweat it — at least not as much.

2. Pay Off Your Debt

Are you only making the minimum payment on your credit card bill each month? Denying your debt won’t make it go away — you’ll only be hurting yourself with unnecessarily high interest rates.

Consider using that holiday bonus to pay off some of your debts. Come up with a debt pay-off strategy, settle your most expensive debts first and look out for ways you can lower your interest rates. Always remember to pay more than the minimum balance if you ever want to climb out of the hole.

3. Contribute to Your Retirement

You’ve received your holiday bonus and almost went into shock over the amount of taxes that were withheld. IRS guidelines require supplemental income to be taxed at 25% — and that includes your bonus money.

You can avoid this heavy taxation by using your holiday bonus to make contributions to your retirement fund, whether you’re enrolled in a 401(k), 403(b) or IRA plan at work.

5. Give to Charity

Are you an animal lover? Do you have a passion for education programs? What about human and civil rights? Whatever causes you care deeply about, there are plenty of charities, both domestic and international, that could benefit from your bonus. Not only will you feel better about yourself, but you’ll also receive a tax deduction on your donation.

6. Fix Something

Surely your house or apartment — or even your car — can’t be in tip-top shape. Pesky plumbing problems? Dirty windows you’ve been meaning to replace for years? Maybe ’tis the season to work on a little home improvement, and your holiday bonus can go a long way in helping you get that done.

7. Book a Vacation

You’ve worked hard all year, so why not put that holiday bonus into a vacation fund? Surely you were planning to take a break this year, right? Studies have shown that taking a vacation is equally as important to your health as watching your diet or getting enough exercise. In fact, a holiday break can reduce the risk of heart attack by 30 percent in men and 50 percent in women.

Don’t be afraid to ask your boss for a week off to escape to that exotic island. Your body and mind will thank you.

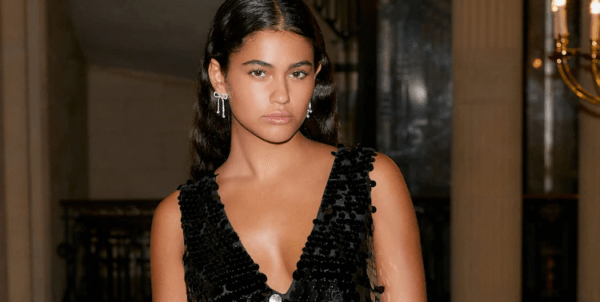

8. Buy New Clothes

Your closet is so packed that you can barely shut the door, yet you wake up every morning staring blankly at your clothes racks and sigh, “I have nothing to wear.” Isn’t it about time to give your wardrobe a makeover?

Remember when you were a teenager and shopping was so much fun? Take that holiday bonus, grab a few girlfriends and have a shopping date. Go into the new year feeling sexy and stylish!

9. Schedule a Massage

Now that you have a bit of extra cash in your pocket, you can finally schedule that massage you’ve been dreaming of. There are numerous benefits of massage, including reduction of stress, pain and muscle tension as well as symptom alleviation of physical and mental diseases.

Whether you prefer the gentle Swedish massage or like to grit your teeth during deep-tissue work, you deserve the opportunity to relax.

10. Join a Gym

Getting in better shape was one of your resolutions this year, wasn’t it? Consider using your holiday bonus to kick start a membership at a gym.

Physical activity has a ton of benefits including weight control, reduction in risk of heart disease and some cancers, strengthening of bones and muscles, and improvement in mental health and mood. Put on those new running shorts you bought at Lululemon and get ready to sweat.

11. Spend on Experiences

Money can sometimes buy you happiness — that is, if you spend it on experiences rather than things. Research has shown that people actually value experiences like adventures and meals more than material goods like cars and new clothes.

If you’re going to splurge, consider using that holiday bonus to try a new, fancy restaurant. Or maybe you can finally go on a hot air balloon ride. If you’re feeling particularly adventurous, jump out of a perfectly good airplane.

12. Enhance Your Career

You’ve earned that holiday bonus because you’re good at your career. But there’s always room for improvement. Why not use your bonus to invest further in your professional skills and employability?

Consider attending a professional conference or earning continuing education credits. Or maybe you could benefit from consulting a career coach or hiring a professional resume service to enhance your professional profile.

After all, you want to make sure that you receive a bigger bonus next year.

Don’t Spend It All in One Place!

No matter how much money you received with your bonus this year, don’t feel pressured to spend it all in one place. You can invest the cash smartly by using some of it to pay off debts and contribute to your retirement fund, but you’ll be a happier, healthier employee if you save some of it to splurge on yourself, too.