How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy can be a daunting prospect, with many different factors affecting what type of cover is most suited to you. Your life insurance policy should depend heavily on what you expect to get out of it, should the worst happen.

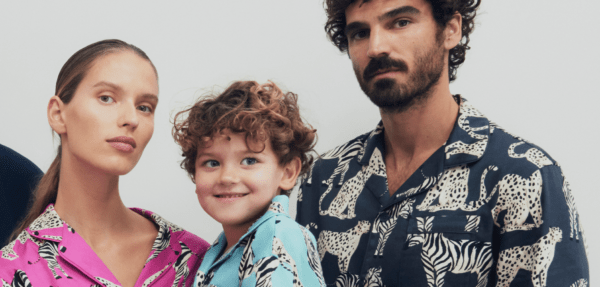

Losing a parent, partner or spouse is certainly one of the most emotionally challenging experiences we can face, and if you add the financial aspect of this loss to the mix, it can seem unbearable to cope. Having life insurance helps lessen the burden when it comes to the aspects of financial stress.

Life insurance may appear difficult to understand at first, but with a helping hand you can simplify it and reach an informed decision. The first thing you need to decide is whether you really need life insurance in the first place.

Do you need life insurance?

Taking out life insurance cover can depend on your personal circumstances. If you have people who depend on you, such as a spouse or young children, then it is likely your salary is important to supporting them. If the worst should happen, aarp life insurance can ensure your dependents are looked after financially. And if you have debt such as a mortgage or private student loans that you wouldn’t want to pass on to your loved ones, life insurance can protect them from inheriting it.

Life insurance is usually taken out as a way to pay the mortgage, support your family’s living expenses or paying school fees. These financial obligations could become a problem if your family does not generate enough income without you.

What life insurance cover should you take out?

If you have decided that you need life insurance, there are many different options available depending on the type of cover you need. When choosing a life insurance policy, you may wish to consider the following: your income, your debts, how many dependents you want to support and even your lifestyle.

You should think about how long you would need cover for. For instance, you can take out cover that will pay out no matter what age you pass away; this is known as whole of life insurance, or you can take out cover for a fixed period of time, which is called level term insurance.

Other types of life insurance policies can provide cover if you are over 50, or if you need cover that will specifically help to pay off mortgage repayments.

The cost of life insurance

To take out life insurance, you will need to pay a monthly premium. It is key that you are able to meet these monthly premiums, otherwise your policy will likely be terminated.

The cost of your life insurance can depend on the type of cover you take out. Factors like your age and health can play a part in how expensive or cheap your monthly premiums are.

If you are hoping to find affordable and suitable life insurance, consider contacting an expert life insurance broker. They can search the market for you, finding the right policy for the right price. By comparing the UK’s top insurance providers, an authorised broker can work with you to find a bespoke policy.

Life insurance policies can be incredibly helpful for your loved ones. Make sure you choose the right policy by understanding the different types and how they could benefit you.