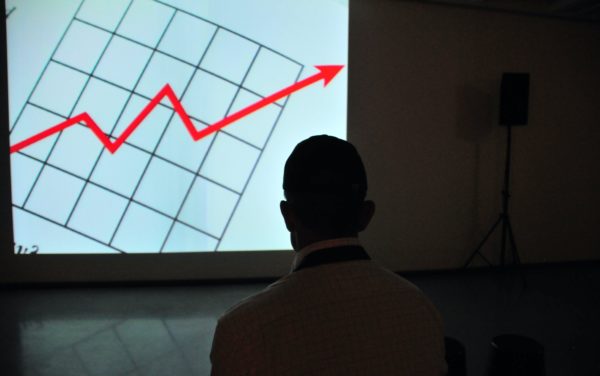

Is Peer to Peer Lending Right for You?

If you’re a seasoned investor, you’ve likely crossed paths with Peer to Peer lending at some point during your career. Perhaps it’s something that has always been on the cards as a way to expand your investment portfolio down the line, or you know of someone who has utilised it previously.

This type of lending contains a variety of features that make it interesting to modern investors. This article delves deeper into its pros and its cons, offering a holistic overview to help determine whether it is the right fit for your current investment strategy.

Understanding Peer to Peer Lending

Peer to Peer lending directly connects investors and borrowers through an easily accessible online network. These networks are managed by P2P platforms, each offering their own unique, mutually beneficial investment options to choose from.

The Pros and Cons of Peer to Peer Lending

The advantages of Peer to Peer lending

- Peer to Peer lending is an accessible investment option: opening an account online is easy and straightforward

- Providers including Kuflink, LandlordInvest and Ablrate require minimum investments as low as £100

- Returns on investment in P2P lending can be exempt of tax thanks to the British government’s IF-ISA arrangement. Note that HMRC tax rules apply.

- The market is competitive, which gives investors the freedom to choose from plenty of investment options including personal loans, small business loans, secured loans and more

- Reputable providers assess each investment opportunity to vet its viability, giving investors some assurance that their money is going to a credible debtor. As always, capital may be at risk.

- Peer to Peer lending often includes hands-on and auto-investment options. This gives investors the opportunity to be as actively (or passively) involved with the investment as they want to be

- Some providers allow investors to sell their loans to other investors on the secondary market, making P2P investments more liquid in comparison to other types of fixed investment

The disadvantages of Peer to Peer lending

- Invested capital is always at risk. Peer to Peer investments do not have FSCS protection, making them higher-risk

- Despite the potential of predictable returns outlined above, there are no guarantees that borrowers will make their payments on time and there is a chance that borrowers might default. However, providers do what they can to vet each investment opportunity to the best of their abilities to mitigate this risk

- Peer to Peer lending requires a lot of due diligence from the investor. Investors opting to utilise this type of investment should do research on the platform and make sure the one they choose is reputable, as well as take the time to gather information about past investment performances

Making Headway into the World of Peer to Peer Lending

UK-based investors looking to leap into the world of Peer to Peer lending have an opportunity to do so with the added benefit of earning tax-free returns.

Keeping this and other considerations in mind, it’s clear that Peer to Peer lending is a modern, versatile investment option for both active and passive investors, as well as both beginner investors and seasoned veterans.

Based on your existing portfolio and the goals you’ve set for your investment strategy, you can now make a rational decision about whether this investment type is the right fit for you.