4 Habits That Actually Cause You To Spend More Money

Are your everyday habits secretly draining your wallet? Discover the sneaky spending pitfalls and learn how to take control of your finances

We’ve all been there – you check your bank account balance and wonder, “Where did all my money go?”

In today’s world of convenience and instant gratification, it’s alarmingly easy to lose track of our spending habits. However, being budget-conscious is crucial, especially in times of economic uncertainty.

Jason Higgs, Senior Deals Strategist at Bountii, explores four habits that may be costing you more than you realise and how to break free from their grip.

Impulse Purchases

Ah, the allure of a good deal or a shiny new gadget!

Impulse purchases are the silent killers of budgets. Whether it’s that ‘buy one, get one free’ offer or the latest tech craze, these spur-of-the-moment buys can quickly add up.

As Jason warns, “Impulse purchases are the enemy of financial freedom. They trick you into thinking you’re saving money when you’re actually spending it.”

Jason’s tips to break this habit:

- Practise the 30-day rule – whenever you feel the urge to buy something unnecessary, wait 30 days before purchasing it. The urge often passes.

- Unsubscribe from promotional emails and unfollow brands that tempt you to spend.

- Leave credit/debit cards at home and only carry cash for essentials when going out.

Subscription Services

In the age of streaming and subscription boxes, it’s easy to accumulate a plethora of monthly charges.

From music and video platforms to meal kits and beauty boxes, these seemingly small fees can snowball into a significant financial burden.

As Jason advises, “Review your subscriptions regularly and cancel the ones you no longer use or need. Those $10 charges add up quickly.”

Jason’s tips to break this habit:

- Review subscriptions quarterly and cancel any you don’t actively use or need.

- Before signing up for a new subscription, give yourself a ‘cooling off’ period of a week to be sure you want it.

- Look for free alternatives like library books/movies instead of paid subscriptions.

Eating Out Too Often

Grabbing a quick bite or meeting friends for drinks can be a convenient and enjoyable way to socialise.

However, these outings can quickly drain your wallet if they become a regular occurrence.

As Jason cautions, “Eating out is a luxury, not a necessity. If you’re trying to get your finances in order, cooking at home should be the norm, not the exception.”

Jason’s tips to break this habit:

- Meal prep on weekends so you have ready-made meals at home.

- Pack lunches for work instead of buying each day.

- For social outings, suggest potluck dinners or meetings at parks/homes instead of restaurants.

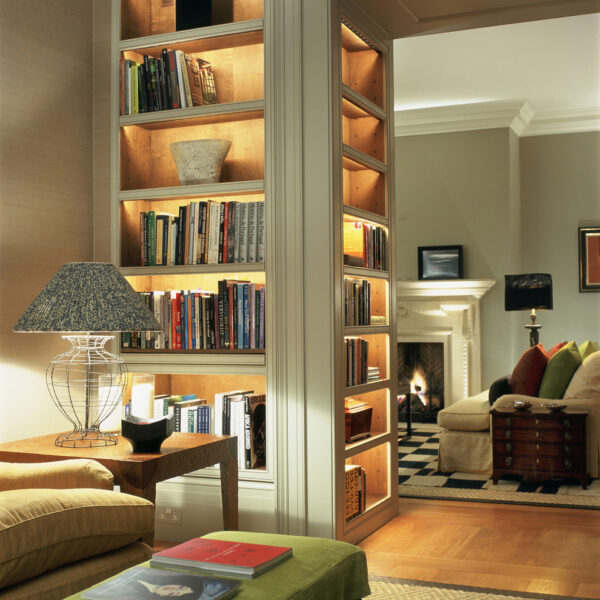

Retail Therapy

Shopping can be a temporary mood booster, but it’s a habit that can wreak havoc on your finances. Interestingly, the same psychology of instant gratification plays a significant role in other areas of spending, like online gaming platforms such as crypto casinos UK. These platforms capitalize on the thrill of risk and reward, offering users the allure of quick wins but often leading to unplanned financial consequences if not approached responsibly.

Whether it’s a new outfit, a gadget, or a home decor item, the thrill of a new purchase is fleeting, while the financial impact lingers. Understanding the drivers behind these behaviors can help create better financial habits and ensure your spending aligns with long-term goals.

As Jason advises, “Retail therapy is a dangerous addiction. Find healthier ways to cope with stress or boredom that don’t involve spending money.”

Jason’s tips to break this habit:

- Find free or low-cost hobby alternatives like hiking, reading library books, or community sports.

- Practise mindfulness – when urges arise, pause and reflect on what you truly need versus want.

- Spend time with supportive friends who don’t pressure you to spend money

To break free from these habits, start by tracking your expenses meticulously. Identify your spending triggers and set realistic budgets for discretionary purchases.

Seek out free or low-cost alternatives for entertainment and socialising, such as exploring local parks, attending community events, or hosting potluck gatherings.

“Cultivate a mindset of contentment and gratitude for what you already have, rather than constantly seeking fulfilment through material possessions,” Jason says.

He adds: “Financial freedom is a journey, and breaking bad spending habits is a crucial step towards achieving your financial goals.”